While recently pursuing a favorite pastime – searching through Securities and Exchange Commission (SEC) filings for publicly traded companies – I saw that Devin Nunes, the CEO of Trump Media & Technology Group and others associated with Trump Media did a deal to purchase a publicly traded company Blue Water Acquisition Corp. III. I then saw that a few months prior to the deal the CEO of Blue Water, Joseph Hernandez, attempted an unsuccessful $10 billion bid to acquire the U.S. assets of Citgo Petroleum, which is majority owned by Venezuela. With Trump and his administration bombing boats in Venezuela and killing dozens of people in what some call war crimes fueled by oil interests, the latest Nunes and Trump Media related business caught my attention.

However, there is no indication that Devin Nunes or others associated with Trump Media who are now officers and investors in Blue Water Acquisition Corp. III were involved with the prior bid by Blue Water to acquire Citgo’s U.S. assets and there is no indication of any wrongdoing in the items reported here. But it does seem likely that Nunes and the new officers and owners of Blue Water would, at a minimum, have been aware of the $10 billion bid for Citgo.

Since the Trump administration and Trump family businesses all have a somewhat loose definition of ‘conflicts of interest’ it will be interesting to see if Blue Water or any other Trump-linked businesses, show up in future opportunities to profit from the bombings in Venezuela. And even if not related to Venezuela, it will be interesting to see what business combination Blue Water Acquisition Corp. III pursues given its many links to Trump Media, which is majority owned by the U.S. president.

Trump Admin bombings, killings and oil interests in Venezuela and a years-long saga over Venezuelan state-owned Citgo Petroleum

In the past few months Donald Trump and his administration, including ‘Secretary of War’ Pete Hegseth, Secretary of State Marco Rubio, and advisor Stephen Miller, have conducted multiple lethal boat attacks killing dozens of people in Venezuela. This week the CIA carried out a drone strikeon a port facility in Venezuela, the first attack on land. The Trump administration claims the attacks are against narco-terrorists and are meant to keep drugs out of the U.S., but many legal experts say the attacks are war crimes and are fueled by a showdown over oil reserves.

As these attacks have been carried out, some news related to Venezuelan oil has gone largely under the radar – the years-long saga of Citgo Petroleum – which is majority owned by Venezuelan state-owned oil company Petróleos de Venezuela, S.A. (PDVSA) which has a history of massive debts, loans, lawsuits and criminal prosecutions. A years-long attempt by the U.S. to auction off Citgo Petroleum’s U.S. based refineries may be coming to a close, even though Citgo is majority owned by Venezuela, which denounces the sale as fraudulent and forced.

I followed Citgo briefly years ago while researching Russian oil company Rosneft. In 2016 Rosneft made a loan to Citgo parent PDVSA in exchange for a note to claim 49.9% ownership. Some highlights of the PDVSA transactions with Rosneft are on this .gov site. In 2017 I had included Citgo on the top right of the second more detailed chart on Rosneft here. According to the U.S. subsidiary of PDVSA, PDV Holding, in 2023 the stock certificate for the 49.9% shares pledged to Rosneft was recovered and the Rosneft lien was terminated.

The auction and bid for Citgo assets is a complex story and has involved the consent of the U.S. Treasury’s Office of Foreign Assets Control (OFAC), and spanned the terms of Trump, Biden, and now Trump again. My (novice oil industry) understanding of this story is that Venezuela’s PDVSA has owned Citgo since the 1980s under then president Hugo Chávez. The company has incurred massive debts and has received significant loans and financing from Russia and China. PDVSA and Citgo have been subject to lawsuits from businesses and creditors in the U.S. and Canada, led by Canadian mining company Crystallex. And to complicate things further several executives of PDVSA and Citgo have been accused of bribery, arrested, imprisoned, and some freed as part of prisoner swaps.

Donald Trump has been trying to oust Venezuelan president Nicolás Maduro since Trump’s first term. In 2019 the Trump admin imposed sanctions on Venezuela and PDVSA freezing assets in the U.S. In 2022 U.S. District Judge Leonard Stark approved the sale of shares in Citgo’s parent to pay back money owed by Citgo to Canadian firm Crystallex and others. And in December 2025 Judge Stark approved one of three recent bids in the auction of Citgo parent company PDV Holding.

Venezuela has been pushing back against the sale and called the deal fraudulent.

In a coincidental thread of this story, one of the three companies that bid for Citgo this past September was taken over a few months later by several people who also run, invest in and partner with Trump Media, one of Donald Trump’s most important businesses, and the owner of Truth Social.

Blue Water Acquisition Corp. III was one of three companies to recently bid for the U.S. refineries of Venezualen-owned Citgo Petroleum

Three companies recently bid for PDV Holding, the U.S. subsidiary of PDVSA that owns Citgo Petroleum Corporation – Gold Reserve, a Canadian mining company, Blue Water Acquisition Corp. III, a publicly traded shell company, and Amber Energy.

On November 25, 2025 U.S. Judge Stark approved the acquisition of Citgo parent PDV Holding, Inc. by Amber Energy for $5.9 billion. Amber is part of Elliott Investment Management, a firm founded by hedge-fund billionaire Paul Singer, who donated $1 million to Trump’s inaugural fund. However, Gold Reserve is challenging the decision.

The bid by Blue Water was the highest amount, and of the three bids, a surpise late entry in the bidding process, and has since been suspended. I was unable to find any detail on how Blue Water had the expertise or resources to support a $10 billion bid for Citgo.

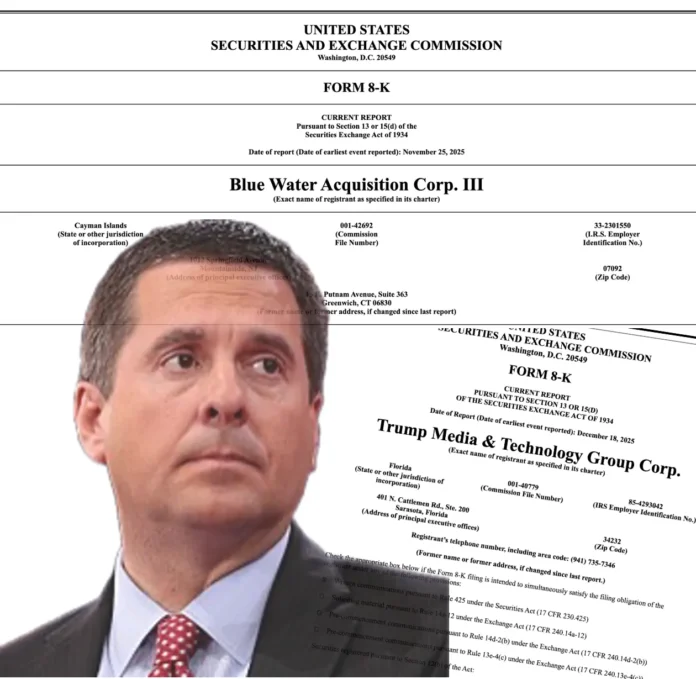

Blue Water Acquisition Corp. III, a SPAC (Special Purpose Acquisition Company), was incorporated in the Cayman Islands and went public this year with plans to combine with another operating business in the future.

In September 2025 the founder and then CEO of Blue Water Acquisition Corp. III, Joseph Hernandez, attempted a $10 billion bid to acquire Citgo. The bid was abandoned in mid November, two weeks before Blue Water announced it was acquired by Yorkville and new leadership that includes Devin Nunes and Scott Glabe from Trump Media.

Joseph Hernandez, the former CEO of Blue Water Acquisition Corp. III runs Blue Water Venture Partners and has an interesting past which includes a recent bid to become mayor of New York City and plans to run as New York state comptroller in 2026. Hernandez was previously CEO of Blue Water Vaccines, later renamed Blue Water Biotech and ran Blue Water Real Estate Holding. Blue Water Real Estate had owned Gainesville Country Club which closed in 2022 and was sold in a foreclosure auction to pay off approximately $2 million of Hernandez’s debts. Hernandez was later sued by former lawyers for over $500,000 of debt.

In early December a new company run by Joseph Hernandez, Blue Water Acquisition Corp. IV, announced plans to raise $125 million in an IPO.

There is no indication that the bid by Blue Water Acquisition Corp. III and Hernandez has any connection to the almost overlapping sale of Blue Water Acquisition Corp. III to a team linked closely to Trump Media & Technology Group. But it does seem like an odd coincidence that Hernandez made such an odd bid just prior to selling the company to close associates of Trump.

Devin Nunes and others associated with Trump Media & Technology Group and Yorkville Advisors are new officers of Blue Water Acquisition Corp. III

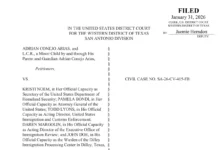

A November 2025 SEC filing described the purchase agreement for Blue Water Acquisition Corp. III for $7.2 million, with new directors and officers, many linked to Trump Media & Technology Group, and Yorkville Advisors, a significant investor and partner of Trump Media.

On November 25, 2025, Blue Water Acquisition Corp. III (the “Company”), Blue Water Acquisition III LLC (the “Prior Sponsor”) and Yorkville BW Acquisition Sponsor, LLC (the “New Sponsor”) entered into a Purchase Agreement (the “Purchase Agreement”). Pursuant to the Purchase Agreement, on November 25, 2025, the New Sponsor (i) purchased from the Prior Sponsor (a) 6,325,000 shares of Class B ordinary shares, par value $0.0001 per share, of the Company (each, a “Class B Ordinary Share”) and (b) 430,000 private placement units (each, a “Private Unit”), with each Private Unit comprised of one Class A ordinary share, par value US$0.0001 per share, of the Company (each, a “Class A Ordinary Share”), and one-half of one warrant, with each whole warrant entitling the holder to purchase one Class A Ordinary Share, at an exercise price of $11.50 per share (each, a “Private Warrant”), for an aggregate purchase price of $7,200,000 and (ii) upon closing, became the sponsor of the Company (together, the “Purchase”).

As a condition of the November 25, 2025 purchase the then-existing board of directors and officers all resigned and new board directors and officers were elected: Kevin McGurn, Devin Nunes, Scott Glabe, Mark Angelo, and Mark Hiltwein would be the new directors and Mark Angelo the Chairman of the board. Kevin McGurn was appointed CEO and Troy Rillo was appointed CFO.

Devin Nunes is the CEO of Trump Media & Technology Group (TMTG), the company that runs Truth Social and is majority owned by the U.S. president through the Donald J. Trump Revocable Trust. New Blue Water director Scott Glabe is General Counsel of TMTG.

Blue Water CEO Kevin McGurn is an advisor to TMTG and is also the CEO of New America Acquisition I Corp, a company launched with Eric and Donald Trump Jr. (as I reported here). McGurn is also CEO of Yorkville Acquisition Corp.

Blue Water CFO Troy Rillo is also CFO of Yorkville Acquisition Corp. and a partner of Yorkville Advisors.

Blue Water board director Mark Angelo is President and Managing Member of Yorkville Advisors.

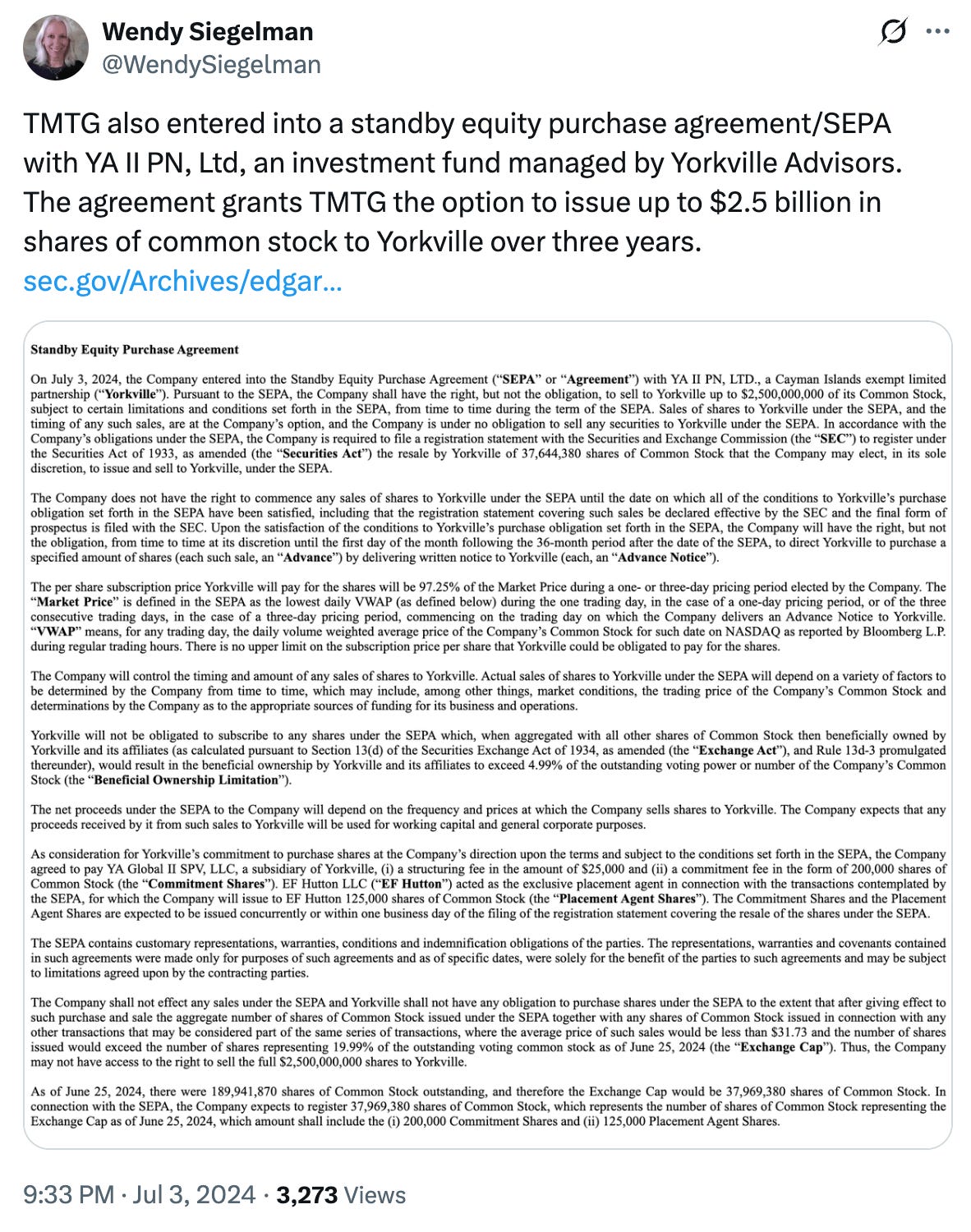

Yorkville Advisors has been an investor in Trump Media & Technology Group since 2022 and since then has been involved in multiple financing and business deals with TMTG. In February 2023 TMTG entered into a standby equity purchase agreement/SEPA with YA II PN, Ltd, an investment fund managed by Yorkville Advisors. The agreement granted TMTG the option to issue up to $2.5 billion in shares of common stock to Yorkville over three years.

More recently TMTG, Yorkville Advisors and Charles Schwab have partnered together to expand investment vehicles and TMTG, Yorkville and Crypto.com have partnered together to launch ETFs.

Per this 13D filing various Yorkville entities led by Mark Angelo own just over 20% of Blue Water Acquisition Corp. III ordinary shares.

Per this 13D filing several Harraden Circle entities run by Frederick V. Fortmiller Jr. own over 6.6% of Blue Water ordinary shares.

Frederick V. Fortmiller Jr. (aka Fritz Fortmiller) is an investor in many other companies and some are linked to Trump: Trump Media & Technology Group, Yorkville Acquisition Corp (9%), New America Acquisition Corp.(6.6%), a company launched with Eric and Donald Trump Jr., Renatus Tactical Acquisition Corp. (8.75%), a firm run by former CEO of DWAC which merged with TMTG, various Cantor Fitzgerald entities, Cantor was co-founded by Howard Lutnick, Trump’s Commerce Secretary, and GrabAGun, a firm backed by Donald Trump Jr.

Trump Media & Technology Group plans a $6 billion merger with TAE Technologies

One of the remarkable things about Trump-affiliated business people is how they can all manage to juggle so many balls at once, serving as leaders of multiple large businesses, often in completely unrelated industries.

As Devin Nunes takes on the role of a board director of Blue Water, he is leading Trump Media & Technology Group in a huge new direction – a planned merger with fusion power company TAE Technologies (because a media company and a fusion power company merger makes perfect sense, of course).

I reported here that the deal is valued at $6 billion and the combined company plans to start construction of a utility-scale fusion power plant in 2026. I also reported that in 2012 TAE Technologies, which was formerly called Tri Alpha Energy, co-founded by actor Harry Hamlin, was part funded by Russia’s State Nanotechnology Corporation (Rusnano), and that Rusnano head Anatoly Chubais was on the board of TAE until at least 2019.

As Trump Media proceeds with a billion dollar merger with a fusion power company, several leaders are now running Blue Water, which prior to being sold had made an odd failed $10 billion bid for Citgo. It will be very interesting to see what comes next for Trump Media and Blue Water Acquisition Corp. III.