Nice to see the EU grow up this week.

December 11, 2025

💣 Europe’s €210 Billion Kill Shot: The Day the EU Crushed the Trump–Putin Fantasy With One Financial Nuke

There are days in geopolitics when someone gives a speech, signs a treaty, or launches a missile, and history shifts by a few degrees.

And then there are days like this —

When Europe walked into the global vault, turned the deadbolt on €210 billion of Russian sovereign assets, and effectively told Donald Trump: “You don’t run the world anymore, sunshine. And you definitely don’t run our books.”

While America wrestles with a president who thinks tariffs are math and MRI machines are optional, the EU just executed the kind of decisive economic warfare that actually changes outcomes. No tanks. No threats. No grandstanding.

Just money — weaponized with a level of precision autocrats can’t counter.

And that’s the whole story:

Europe finally learned how to crush Trump and Putin where it hurts most — in their wallets.

The EU Pulls the Trigger: Article 122 and the Lockdown of Russia’s Wealth

Here’s what actually happened, stripped of diplomatic fluff:

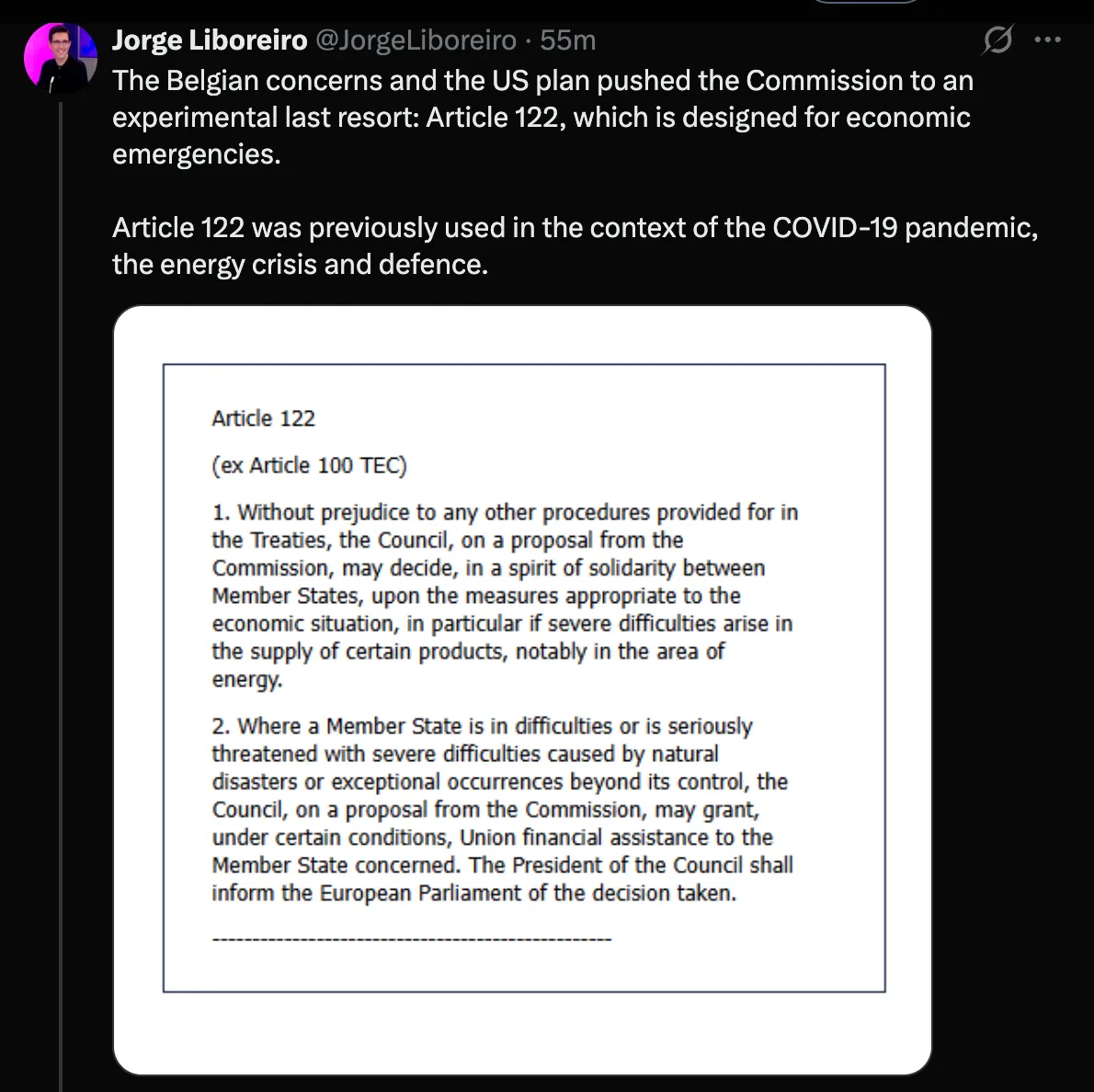

The EU invoked Article 122, bypassed the need for all 27 countries to agree, and indefinitely immobilized the assets of the Russian Central Bank.

Not frozen.

Not paused.

Not “we’ll revisit this later.”

Indefinitely immobilized — as in:

This money isn’t going anywhere until Russia stops being a global arsonist AND pays full reparations to Ukraine.

You know how much money we’re talking?

-

€185 billion sitting at Euroclear in Brussels.

-

€25 billion scattered in private banks across France, Germany, Sweden, Cyprus, and Belgium.

Total: €210 billion Putin will never touch again unless Ukraine is fully compensated, Europe is satisfied, and every economic threat to the continent evaporates.

In geopolitical terms?

This is Europe installing a steel gate between Russia and its emergency cash…

and welding it shut.

Trump and Putin’s “Peace Plan” Just Got Torched

Now here’s where it gets spicy.

Last month, leaked reports revealed Trump and the Kremlin had drawn up a 28-point “peace plan” for Ukraine — a roadmap for surrender disguised as diplomacy.

Buried at point 14 was the bombshell:

Use Russia’s frozen assets for the commercial benefit of BOTH Washington and Moscow.

Translation:

Trump wanted to grab Europe’s money, hand Putin a cut, and call himself a “peacemaker.”

Europe saw that play coming a mile away and said:

“Absolutely not. You don’t get to loot our banking system to stage a photo-op.”

By triggering Article 122, the EU slammed the vault door on Trump’s grubby little hands before he even reached the ATM.

Brussels’ Real Masterstroke: The Threat That Terrifies Trump

Brussels’ Real Masterstroke: The Threat That Terrifies Trump

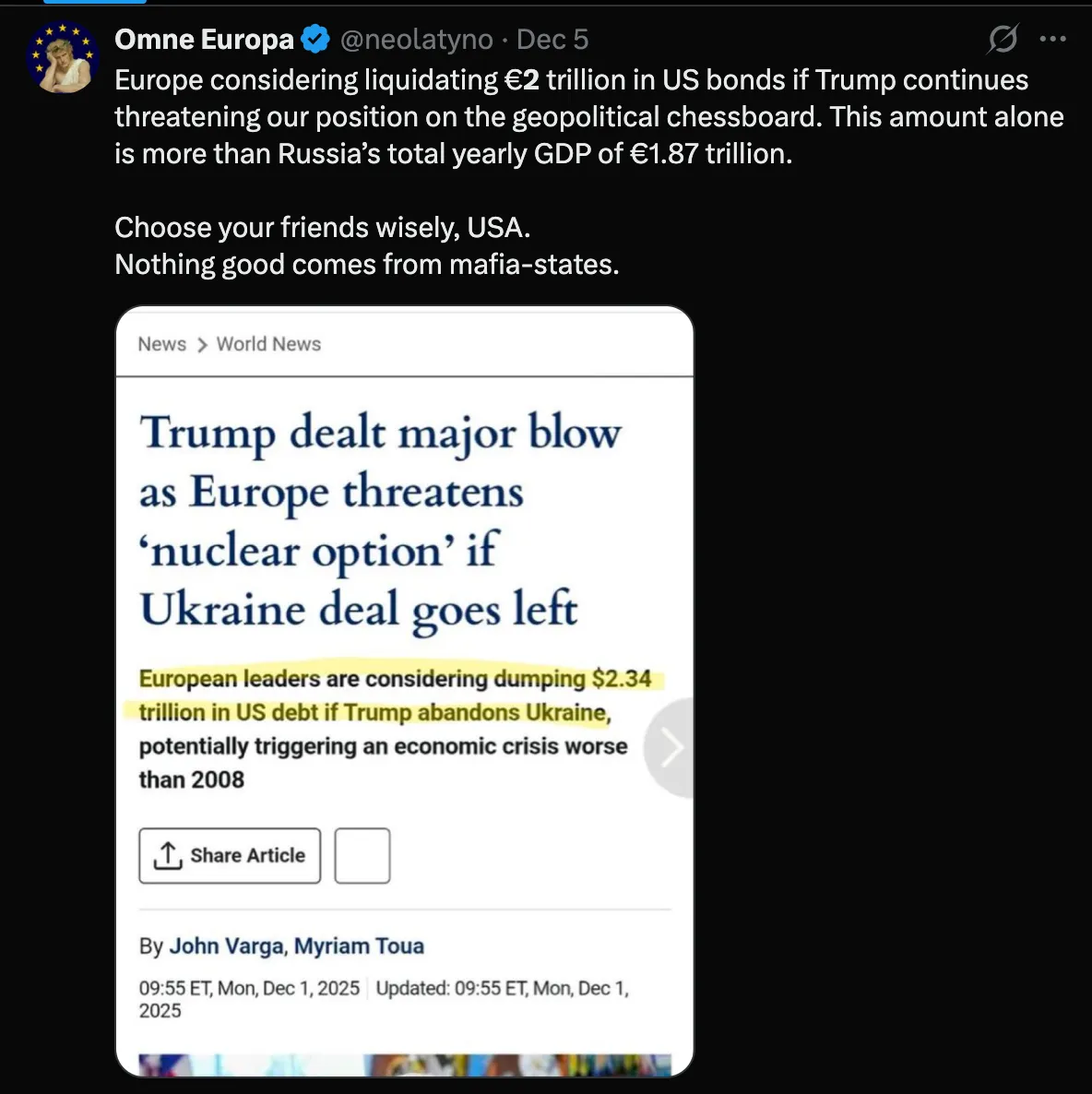

As if locking Russia’s piggy bank wasn’t enough, Europe quietly reminded Washington that it has another weapon:

A coordinated EU bond sell-off.

No threats. No speeches. Just a few polite whispers to the financial press that:

-

Europe controls trillions in U.S. Treasury holdings.

-

If Trump keeps destabilizing NATO, attacking Europe, or trying to steal the Russian assets…

-

The EU could crash U.S. bond markets hard enough to bankrupt “Trump’s America” before the midterms.

This isn’t rhetoric.

This isn’t posturing.

This is arithmetic and a formula directed by Canadian PM Mark Carney going back 8 months.

Carney’s Checkmate: How Canada’s Quiet Bond Play Forced Trump to Drop Tariffs

Read full story

Trump can scream on Truth Social all he wants, but he can’t stop Brussels, Paris, Berlin, and The Hague, or Canada, from dumping Treasuries like they’re FTX tokens.

Europe has finally realized something the U.S. forgot under Trump:

Democracies don’t need to punch autocrats.

They just need to cut off their access to capital.

Money Is How You Crush Tyrants

Putin’s military is failing.

Trump’s domestic chaos is worsening.

But both men still fantasize about controlling global markets.

Europe just put that dream in a wood chipper.

Financial power is the one battlefield where:

-

Trump has no leverage,

-

Putin has no ammunition,

-

And Europe has an entire economic union backing its play.

Autocrats thrive on instability.

Democracies thrive on coordinated pressure.

This week, Europe proved pressure works.

Belgium Melts Down — and It Doesn’t Matter

Yes, Belgium freaked out.

Euroclear doesn’t want to be sued.

Belgium’s prime minister compared seizing Russian wealth to “breaking into an embassy.”

Lawyers filed amendments thick enough to use as booster seats.

Cute.

But irrelevant.

The immobilisation doesn’t depend on unanimity anymore.

Article 122 bypasses the tantrums.

And the assets are locked until Russia stops being a threat.

Belgium can wave legal papers around all it wants — the vault is sealed.

Ukraine Wins the One Thing It Needs Most: Leverage

Europe didn’t just protect its own interests.

It protected Ukraine’s future.

By turning the frozen Russian assets into the foundation for a zero-interest reparations loan, Europe created:

-

Long-term financing for Ukraine’s survival

-

A firewall against Trump forcing a humiliating settlement

-

A guarantee that Putin pays his bill for the war he started

Trump can’t negotiate away money he doesn’t control.

Putin can’t rebuild an economy he can’t access.

Checkmate.

Trump’s Worst Fear: A Recession Made in Europe

Trump’s entire political brand rests on one illusion:

“Only I understand the economy.”

But Europe just showed the world what happens when the adults walk back into the room:

-

They lock $300 billion of Russian assets out of Trump’s reach.

-

They threaten a Treasury sell-off that could triple U.S. borrowing costs.

-

They demonstrate that Trump’s America isn’t the superpower he thinks it is — it’s a borrower dependent on the goodwill of its allies.

Imagine the midterms if Trump triggers a recession caused entirely by EU retaliation.

Imagine him trying to explain that on the campaign trail without the words “perfect,” “beautiful,” or “Obama.”

Europe is done being polite.

They’re playing hardball now.

The Big Takeaway: The Trump–Putin Alliance Just Lost Its Wallet

This wasn’t a symbolic gesture.

This wasn’t a policy tweak.

This wasn’t even “sanctions.”

This was financial warfare, executed with the kind of coordination that only democracies with functioning institutions can pull off.

Europe cut off Putin’s access to capital.

Europe blocked Trump’s plan to use stolen money in a fake peace deal.

Europe signaled that if Trump continues his authoritarian cosplay, they will break his economy with the flip of a switch.

And they did it without firing a single shot.

That’s how you beat autocrats.

Not with threats.

Not with speeches.

But with bookkeeping so brutal it changes the course of history.

FINAL WORD

The Trump–Putin plan relied on one thing:

The belief that the West was too divided, too scared, or too naïve to stop them.

This week, Europe replied with a resounding:

“We’re not your vassal states — we’re your creditors.”

And creditors always get the last word.